A Definitive Guide on User Activation Software in 2023

Welcome to the world of user activation software, where the secret sauce to unlocking the full potential of your product or service lies. In this

Worried about the success of your business? To observe the success of any business, you should measure the KPIs. Curious to measure the KPIs for customer success? Okay, wait! You will understand the essential KPIs for customer success when you go through this article.

Without measuring KPIs, you won’t be able to monitor growth and take the necessary actions for your business. I found it to be a very difficult concept to articulate and even more difficult to accomplish. What constitutes success was a question I continuously asked myself.

Thankfully, my employment doesn’t require me to pose the same pointless philosophical questions. This is due to the wise decision made at some point to develop metrics for success.

And now, I’ll go through the 10 fundamental KPIs for customer success that you must monitor if you want to improve your CS operation in this article.

Now, you have reached the core section of this article. Here, you will get the 10 essential KPIs that will assist you to observe the customer success of your business. So, let’s explore these KPIs to measure the customer success of your business.

To measure a Customer Satisfaction Score (CSAT), you can use a survey question that asks customers to rate their satisfaction with a product or service on a scale, such as a 1-5 or a 1-10 rating.

The question should be phrased as something like, “How satisfied were you with your experience?” or “How would you rate the product/service?”.

Once you have collected responses, calculate the average score, which will give you your CSAT score. For example, if you had 100 responses and the average score was 8 out of 10, then your CSAT score would be 80%.

It’s important to keep in mind that CSAT is just one metric of customer satisfaction, and it should be used in combination with other metrics to get a complete picture of how satisfied your customers are.

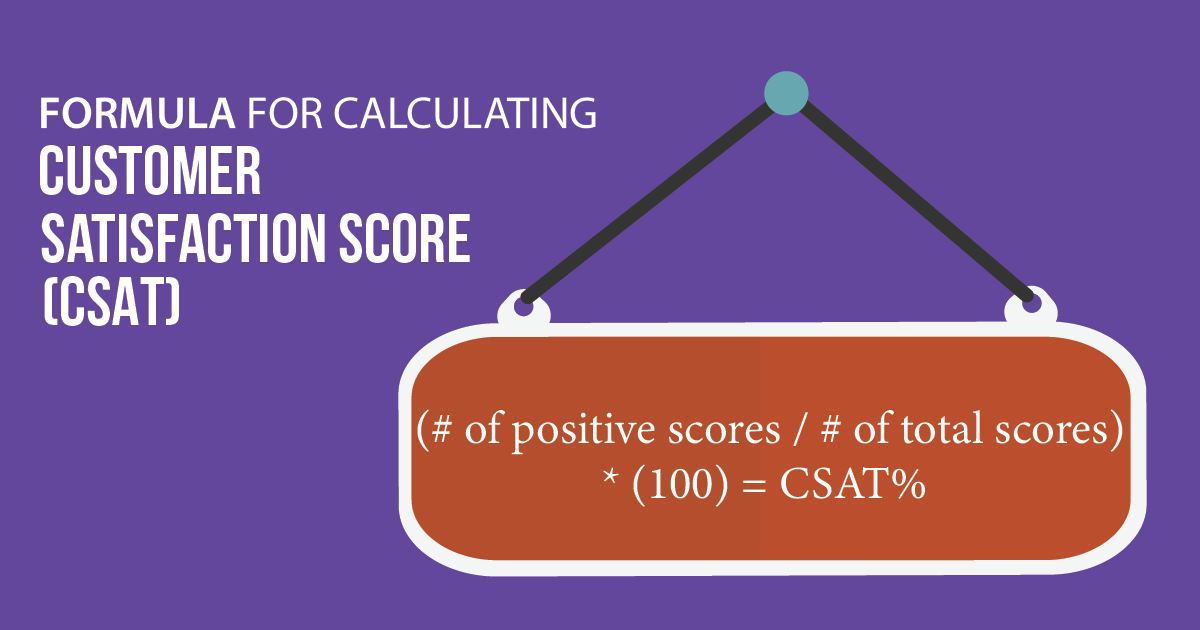

The formula for calculating Customer Satisfaction Score (CSAT):

(# of positive scores / # of total scores) * (100) = CSAT%

Net Promoter Score (NPS) is a metric used to measure customer loyalty and satisfaction with a company, product, or service. It is based on a single question: “On a scale of 0 to 10, how likely are you to recommend this company/product/service to a friend or colleague?”

Customers who respond with a score of 9 or 10 are considered “promoters,” while those who respond with a score of 0 to 6 are considered “detractors.”

The NPS is calculated by subtracting the percentage of detractors from the percentage of promoters, resulting in a score ranging from -100 to +100. A higher NPS indicates higher customer satisfaction and loyalty.

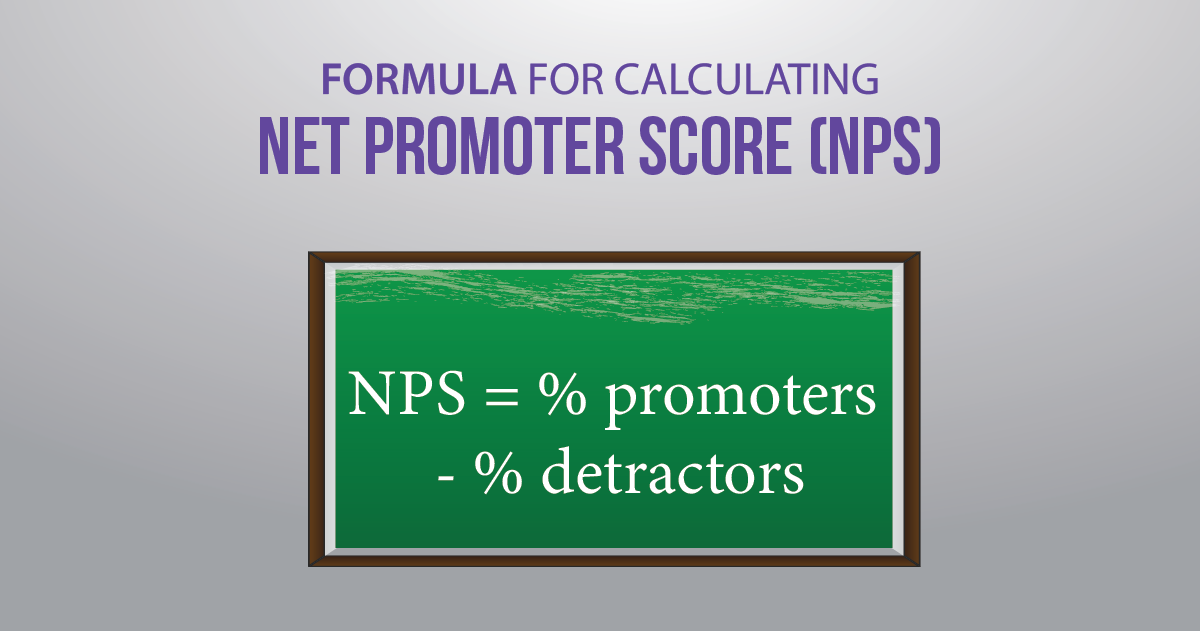

The formula for calculating Net Promoter Score (NPS):

NPS = % promoters – % detractors

Customer Lifetime Value (CLV) is the total amount of money a customer is expected to spend on a company’s products or services over the course of their relationship.

It is a metric used to measure the long-term profitability of a customer and can help businesses make strategic decisions around marketing, customer retention, and pricing.

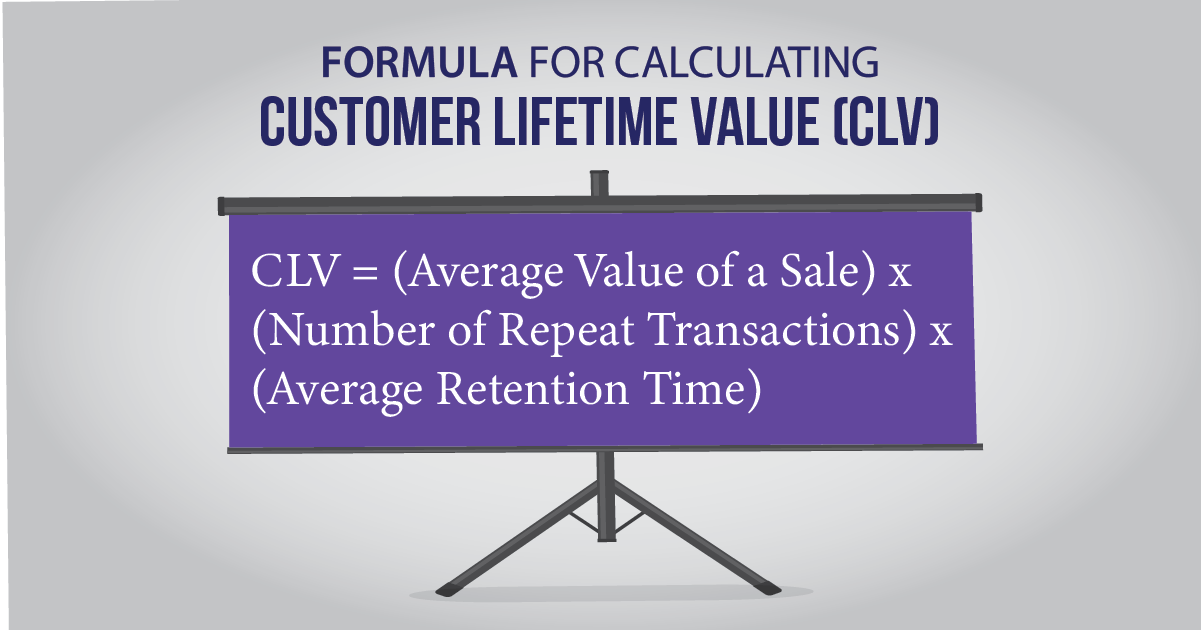

There are several methods to calculate Customer Lifetime Value (CLV), but a basic formula is:

CLV = (Average Value of a Sale) x (Number of Repeat Transactions) x (Average Retention Time)

Here’s a breakdown of each component:

To calculate CLV using this formula, multiply these three components together. For example, if the average value of a sale is $50, the number of repeat transactions is 10, and the average retention time is 2 years, the CLV would be:

CLV = $50 x 10 x 2 = $1,000

This means that, on average, this customer is expected to generate $1,000 in revenue for your company over their lifetime.

Customer Churn Rate is a metric that measures the percentage of customers who stop doing business with a company over a certain period of time. It is used to monitor customer retention and loyalty and to identify the effectiveness of the company’s customer service, product offerings, and marketing strategies.

To calculate the Customer Churn Rate, you need to know the number of customers who stopped doing business with your company during a specific period of time and the total number of customers you had at the beginning of that period.

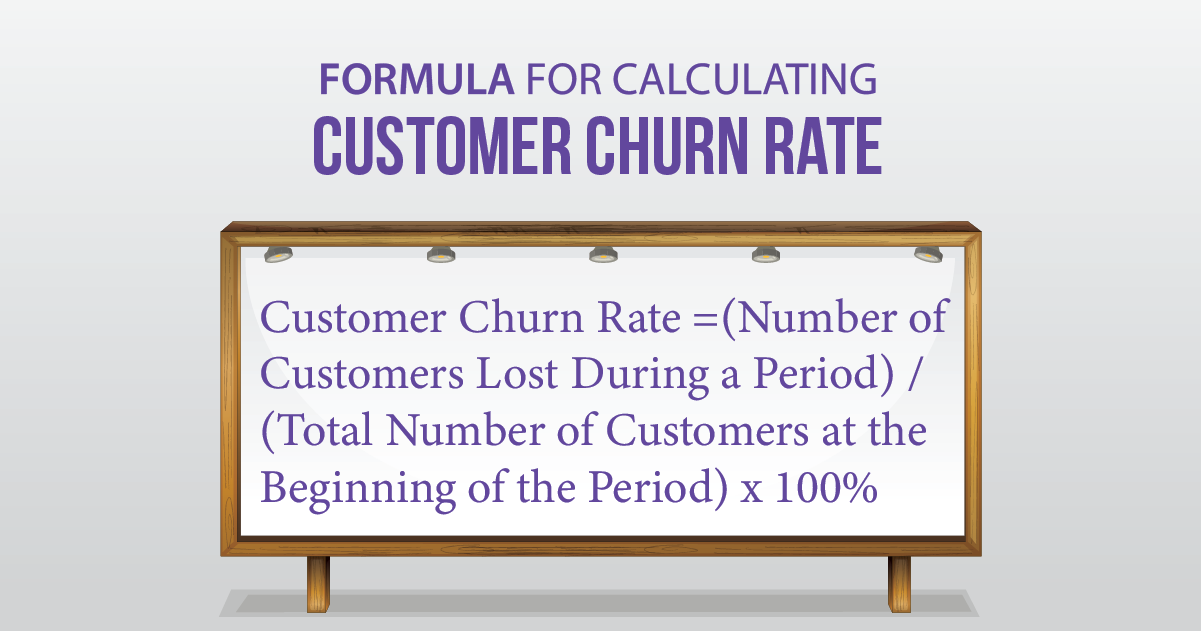

The formula for calculating the customer churn rate is as follows:

Customer Churn Rate = (Number of Customers Lost During a Period) / (Total Number of Customers at the Beginning of the Period) x 100%

For example, if a company had 1,000 customers at the beginning of the month and lost 50 customers during the month, the customer churn rate would be:

Customer Churn Rate = (50 / 1000) x 100% = 5%

This means that the company lost 5% of its customers during that month.

Customer Retention Rate (CRR) is a metric that measures the percentage of customers that a company retains over a given period of time. It is used to evaluate the effectiveness of a company’s customer retention strategies and to identify areas where improvements can be made.

The formula for calculating the Customer Retention Rate is as follows:

CRR = ((E-N)/S) x 100

Where:

For example, if a company had 1,000 customers at the beginning of the month, acquired 100 new customers during the month, and had 900 customers at the end of the month, the Customer Retention Rate would be:

CRR = ((900-100)/1000) x 100 = 80%

This means that the company was able to retain 80% of its existing customers during that month. A high Customer Retention Rate indicates that a company is doing a good job of keeping its customers satisfied and loyal, which can lead to increased revenue and profitability over time.

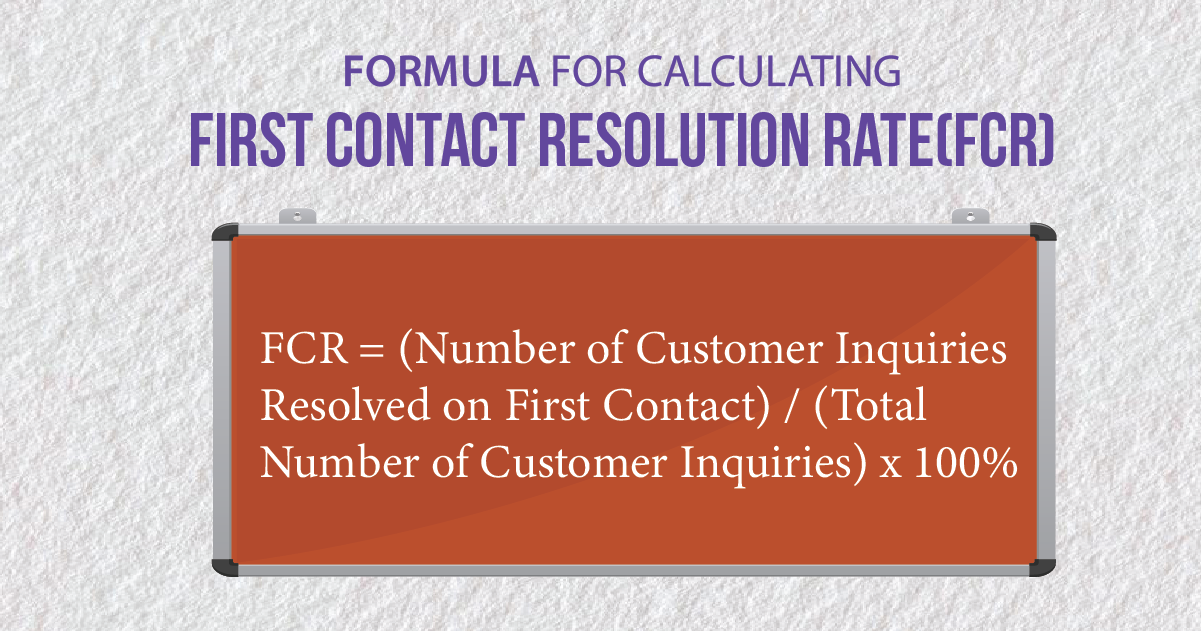

First Contact Resolution Rate (FCR) is a metric that measures the percentage of customer inquiries or issues that are resolved during the first contact with a customer service representative. It is an important metric for assessing the effectiveness of a company’s customer service operations.

To calculate First Contact Resolution Rate (FCR), you need to know the number of customer inquiries that were resolved during the first contact with a customer service representative, and the total number of customer inquiries received during a specific time period.

The formula for calculating First Contact Resolution Rate is as follows:

FCR = (Number of Customer Inquiries Resolved on First Contact) / (Total Number of Customer Inquiries) x 100%

For example, if a company received 1,000 customer inquiries during a month and was able to resolve 700 of them during the first contact with a customer service representative, the First Contact Resolution Rate would be:

FCR = (700 / 1000) x 100% = 70%

This means that 70% of customer inquiries were resolved during the first contact with a representative. A higher FCR indicates that a company is able to efficiently and effectively handle customer inquiries and issues, leading to improved customer satisfaction and loyalty.

Free Trial Conversion Rate is a metric that measures the percentage of users who sign up for a free trial and become paying customers. It is an important metric for companies that offer free trials as a way to acquire new customers, as it helps to assess the effectiveness of their free trial strategy.

To calculate the Free Trial Conversion Rate, you need to know the total number of users who signed up for a free trial and the number of users who converted to paying customers during a specific time period.

The formula for calculating Free Trial Conversion Rate is as follows:

Free Trial Conversion Rate = (Number of Users who Convert to Paying Customers) / (Total Number of Users who Signed Up for Free Trial) x 100%

For example, if a company had 1,000 users sign up for a free trial and 100 of them became paying customers, the Free Trial Conversion Rate would be:

Free Trial Conversion Rate = (100 / 1000) x 100% = 10%

This means that 10% of users who signed up for the free trial became paying customers. A higher Free Trial Conversion Rate indicates that the free trial is effective in converting users to paying customers, which can lead to increased revenue and profitability over time.

Customer Effort Score (CES) is a metric that measures the ease of a customer’s experience when interacting with a company. It is a customer satisfaction metric that focuses on how much effort a customer had to put in to resolve their issue or accomplish their task, and it is commonly used to evaluate the overall customer experience.

To calculate Customer Effort Score (CES), follow these steps:

The formula for calculating Customer Effort Score is as follows:

CES = (Total Scores Given by Customers) / (Total Number of Respondents)

For example, if a company surveyed 100 customers and received a total score of 500, the Customer Effort Score would be:

CES = 500 / 100 = 5

This means that, on average, customers found their experience to be moderately easy. A higher CES score indicates that customers found their experience to be easier and more convenient, which can lead to increased customer loyalty and positive word of mouth.

Monthly Recurring Revenue (MRR) is a financial metric used to measure the predictable and recurring revenue generated by a company’s subscription-based business model.

MRR represents the total amount of revenue a company expects to receive on a monthly basis from its customers who are subscribed to its services or products.

To calculate MRR, you need to sum up the monthly recurring revenue from all of your active subscriptions. This includes any recurring revenue from new subscriptions and also any revenue from existing customers that have renewed their subscriptions.

Here’s a step-by-step guide to calculating MRR:

MRR is an important metric for subscription-based businesses as it provides a predictable and stable revenue stream that can be used for forecasting and planning purposes.

It can also be used to measure the overall health of a business and its ability to generate recurring revenue over time.

Customer Renewal Rate is a metric used to measure the percentage of customers who renew their subscriptions or contracts with a business over a given period of time. It is commonly used by subscription-based businesses to gauge customer loyalty and the effectiveness of their retention strategies.

To calculate the Customer Renewal Rate, follow these steps:

For example, if you had 500 customers eligible for renewal and 450 of them renewed, your Customer Renewal Rate would be 90%.

Customer Renewal Rate can be used to track trends in customer loyalty and retention over time. A high renewal rate indicates that customers are satisfied and see value in your product or service, while a low renewal rate may signal a need to improve the customer experience or adjust pricing and offerings.

The attainment of customer success and increasing user retention is associated with all of the customer success measures covered in this article. You may pinpoint your customer success efforts’ weak points, strengthen them, and address them by monitoring and responding to these KPIs.

KPIs for customer success are essential for monitoring the status of CS goals, impacting retention, and eventually generating recurrent income. Want to know how?

Momentive uses Gong to create a thorough strategy for coaching client success and to increase engagement and retention.

Welcome to the world of user activation software, where the secret sauce to unlocking the full potential of your product or service lies. In this

Have you ever wondered how businesses track user actions on their websites or apps? How do they measure the success of their marketing campaigns and

Have you ever wondered how users navigate through websites or apps? How do they seamlessly move from one screen to another, making decisions and accomplishing

Do you want to create a product that truly speaks to your customers? Are you looking for ways to gather valuable feedback and improve the

Ever wondered how often customers visit your online store before making a purchase? Or which promotional messages drive higher-value sales? User behavior segmentation holds the

In a world where data reigns supreme and competition is fierce, businesses are constantly searching for that extra edge that propels them ahead. Enter the